Do No-Credit Check Loans Exist?

Today, you’re going to know exactly – do no-credit payday loans exist? And, how can I get no credit check payday loans in 2021?

Specifically, you’re going to learn all the basic requirements needed to get a no credit check payday loan, and how this kind of financial assistance will be beneficial to your daily living.

Let’s dive right in!

What is a Credit Check?

A credit check is said to be when a firm or company runs through your credit profile to prove that you are credit-worthy. And, it’s not only lenders that perform these credit checks – lots of companies do!

When you apply for a payday loan, your payday lender may or may not perform a credit check which is supposed to highlight if you’ve ever had problems or struggled to meet up your financial responsibilities in the past.

Credit checks are made of two types:

A soft Credit check is best depicted as a quick inspection of one’s credit report. Lenders do often carry-on soft searches to decide whether your application would be okay without fully assessing your entire credit history. Its benefits are that you won’t be visible to any other company conducting credit checks on your file.

A soft credit check is often what most companies will refer to as a no credit check.

A hard credit check is a comprehensive and full review of one’s entire credit report. When you settle down writing an application for a loan, the lender you’re applying for may perform a hard check to ensure that you meet up their qualification criteria.

Every hard check that is made on your credit rating is recorded on your credit file and any company conducting a hard search too in the future would be able to see that you’ve applied for credit before.

What are No-Credit CheckLoans?

No credit check loans could be said to be when your lenders consider your paycheck and your expenses in your bank statement and use it to ascertain how much loan you can afford without really considering or even having to see your credit history before offering you a loan. As we do know, measuring up for a loan is a lengthy and nerve-racking process, especially when you are in very desperate need of money.

No credit check loans do not secure loan approval though!

Whether or not you qualify for a particular loan depends on your income to secure the loan instead.If you’re little on cash and you really need to satisfy a crucial disbursement or expense, a payday loan may seem like a feasible option for you.

Do No-Credit Check Loans Exist?

If you’ve been speculating whether no credit check loans exist or not, the correct answer to your question is yes, they do!

When people are looking for no credit check loans, they would be anticipating a procedure that doesn’t involve a lender accessing their credit history at all. In real fact though, no credit check loan actually involve a lender using the process (soft credit check) as discussed earlier in the guide, which gives him the information he needs to make a lending decision.

The main difference here is that a soft credit check would not impact your credit score and the other lenders won’t be able to see that a search has been made.

Without carrying on a credit check at all, the lender has no possible way of knowing whether you can afford to repay the loan and disbursing credit without this information is not only irresponsible but can extend to a spiral of debt troubles for borrowers

All applicants should be conservative and careful of any lender that claims to offer them an assured loan without conducting any possible form of credit check, as this kind of lending is not regulated.

Why Would I Possibly Need a No-Credit Check Payday Loan?

Getting quick cash for an unexpected financial need cannot be overstressed…

These unannounced circumstances could include deficient funds for monthly, weekly or even daily budgets, medical casualty (emergencies), car or home appliance breakdown or malfunction, to cover up for some personal expenses and many more you can possibly think of.

With no credit check personal loans, you can have access to a short-term loan that you actually need without having to get a deep background check on your current credit report. This could be the most comfortable and ensured option for you if you’ve got a not so good credit score that leaves you so unentitled for most loans, or maybe if you did have a recent drop on your credit score.

Almost all credit unions or banks would demand you to undergo a credit check with them in order to get greenlighted for your loans. However, some lenders are willing to bypass the process.

What are the Basic Requirements to Get a No-Credit Check Payday Loan?

People who mostly do qualify for these 24 hours payday loans are those earning less than $40,000 annually, people without a home of theirs, divorced or separated. Based on research, most borrowers do generally use payday loans to help cover for average living disbursements over the run of months and not needfully emergencies.

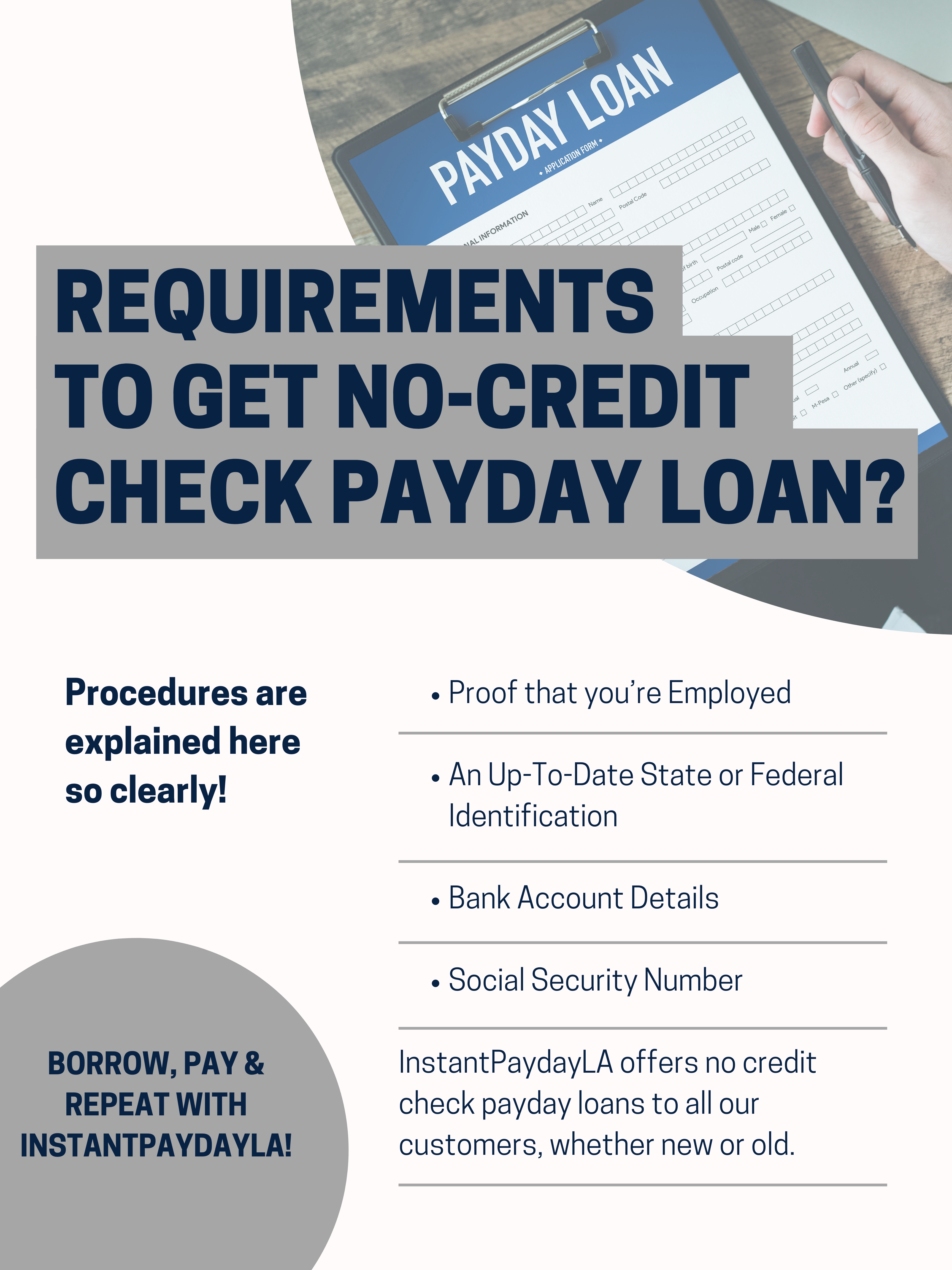

The requirements for a no credit check payday loan include:

- A proof that you’re employed

- An up-to-date state or federal identification

- Bank account details

- Social Security Number

The following are the basic features of no credit check personal loans:

- Loans offered range from $500 to $35k

- Great for all credit types

- Can take large and personalized loans to fit your credit situation

- They are 24 hours payday loans

- Services are online and are offered in all 50 states of the country.

The Best No-Credit Check Payday Loan Solution

InstantPaydayLA is a 1-hour payday loan company whose major objective is to make it easier for transactions to take place, as well as larger loan alternatives to be available to borrowers with both good and not so good credit conditions.

InstantPaydayLA is an ideal place for even new customers.

All steps and procedures here are explained so clearly. We offer no-credit-check payday loans to all our customers, whether new or old. The conditions of our various loan offers are very flexible and, provided your monthly income suits with your payment criteria, both customer and lender benefits in both ways.

Once the swift and easy process is completed, it would take merely 24 hours for you to receive your payday funding. You’d be matched with desirable lenders, thereby allowing you to choose from the best